In today’s fast-paced business world, it is crucial to have a thorough understanding of your finances. Knowing your working capital, and how to calculate it using the working capital formula, is an essential tool for any business owner or financial manager.

The working capital formula is an equation used to measure a company’s liquidity. Simply put, it represents the amount of cash available to finance a company’s day-to-day operations.

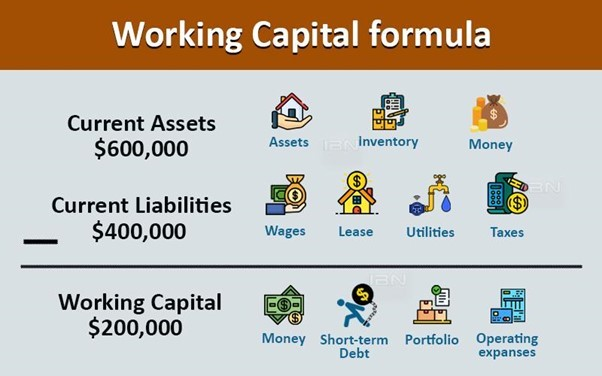

This formula is calculated by subtracting a company’s current liabilities from its current assets. Current assets include things like cash, accounts receivable, and inventory, while current liabilities include things like accounts payable and short-term debt.

By regularly calculating your company’s working capital, you can identify any potential cash flow or liquidity issues that may arise. This information can help you make informed decisions, such as adjusting production schedules or negotiating better payment terms with suppliers.

Addition

Understanding the working capital formula can help you identify areas of your business that may require improvement. For example, if you have a high level of inventory and low accounts receivable, it may indicate that your sales team needs to work harder to improve their receivables collection.

Conclusion

Understanding the working capital formula is a valuable tool for any business owner or financial manager. Regularly calculating and monitoring your working capital can help you make informed business decisions and improve your overall financial health. So, why not boost your financial knowledge today by learning more about the working capital formula?

Read more: Boost Your Financial Knowledge with the Working Capital Formula